Pricing Engine (FDK)

Numerical Libraries for OTC Products

Highly efficient

OTC pricing engine

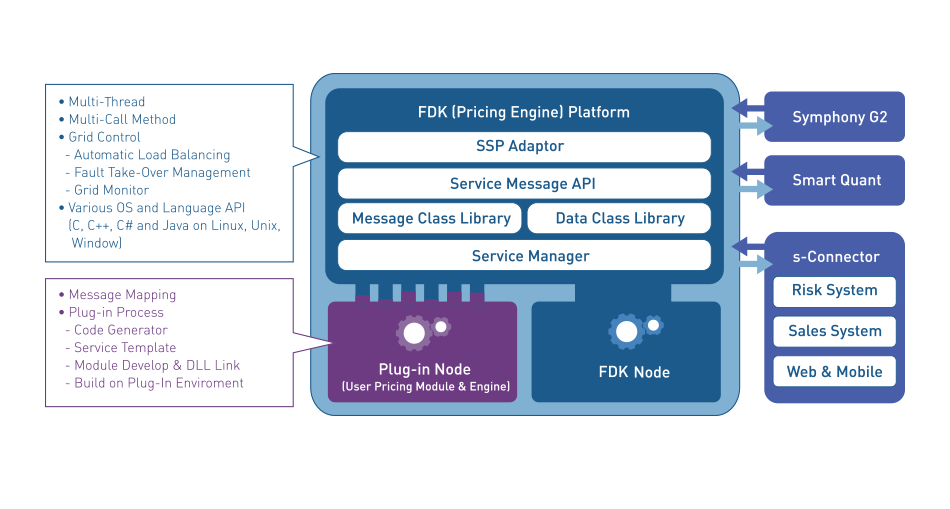

The Symphony FDK is an OTC pricing engine which efficiently computes fair value, risk, and expected forward cash flow of derivative products. It is able to process all products from vanilla products to the most complex structures.

The FDK is embedded within the Symphony G2 as well as its sub products including The Smart Quant (SSQ), Product Control (SPC), and Trade & Position (STP). Furthermore, it is also deployed independently for clients with centralized or stand-alone pricing service needs.

OTC pricing engine

The Symphony FDK is an OTC pricing engine which efficiently computes fair value, risk, and expected forward cash flow of derivative products. It is able to process all products from vanilla products to the most complex structures.

The FDK is embedded within the Symphony G2 as well as its sub products including The Smart Quant (SSQ), Product Control (SPC), and Trade & Position (STP). Furthermore, it is also deployed independently for clients with centralized or stand-alone pricing service needs.

The FDK is serviced in three ways.

For one, it is embedded in the Symphony G2 with a corresponding

pricing engine library and compatible API (C, C++, C# and Java). The client

installs the FDK on their servers (Linux or Unix) and accesses the

interface without limit through the API.

Software as a service (SaaS) is the second method, in which the client is able to access the FDK within the Symphony Data Centre through the same API. The user registers at www.SymphonyG2.com and freely accesses the FDK without the obligation of installing the software. This method offers the FDK’s updated calculation models and comprehensive market data, as well as the grid computing service at minimal cost.

Finally, we also offer the full, stand-alone FDK DLL version which runs on Windows. This program generates a customized library, and the user may alter the source code for optimal usability and efficiency.

Software as a service (SaaS) is the second method, in which the client is able to access the FDK within the Symphony Data Centre through the same API. The user registers at www.SymphonyG2.com and freely accesses the FDK without the obligation of installing the software. This method offers the FDK’s updated calculation models and comprehensive market data, as well as the grid computing service at minimal cost.

Finally, we also offer the full, stand-alone FDK DLL version which runs on Windows. This program generates a customized library, and the user may alter the source code for optimal usability and efficiency.